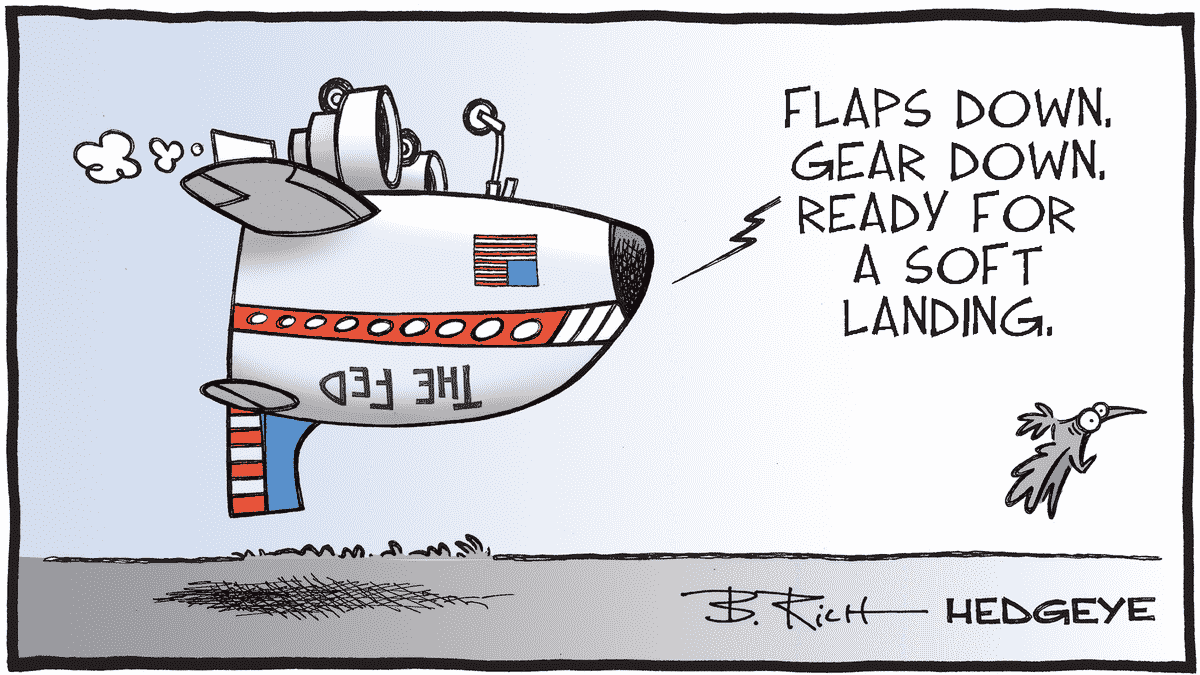

Staying the Course: Financial markets are now predict a soft landing for the economy.

At the start of the year most market commentators seemed convinced that the economy was heading for a hard landing and by the end of the year interest rates would need to come down to get us out of a recession. The obvious trade was to get out of equities and load up into bonds as they would be beneficiaries of higher income and falling rates. But equities have continued to climb while yields keep edging upwards and now market commentators agree that we are in for a soft landing. It’s why as an investor the best trade is to ignore media predictions and stay the course with the portfolio that has been created for you by your advisor.