Investment Market Wrap with Sam Stillone and Dr Steve Garth - March 2024

Welcome to the Insight Private Wealth economic and investment market wrap for the 12 months to 31 March 2024.

Sam Stillone Principal at Insight Private Wealth, and Dr Steve Garth, Investment Committee Member, take you through the highs and lows of the quarter sharing invaluable insights on market performance.

Investment Market Wrap with Sam Stillone and Dr Steve Garth - December 2023

Welcome to the Insight Private Wealth economic and investment market wrap for the 12 months to 31 December 2023.

Sam Stillone Principal at Insight Private Wealth, and Dr Steve Garth, Investment Committee Member, take you through the highs and lows of the quarter sharing invaluable insights on market performance.

Investment Market Wrap with Sam Stillone and Dr Steve Garth

Welcome to the Insight Private Wealth economic and investment market wrap for the 12 months to 30 September 2023. Sam Stillone Principal at Insight Private Wealth, and Dr Steve Garth, Investment Committee Member, take you through the highs and lows of the quarter sharing invaluable insights on market performance.

A new way to think about inheritance

Is inherited wealth a powerful tool or a destructive influence?

David York thinks it can be both, depending on how you define and use it. In this thought-provoking talk, he argues that we need to stop envisioning intergenerational wealth transfers in purely financial terms and start thinking about them as opportunities to share values and connections to the next generation.

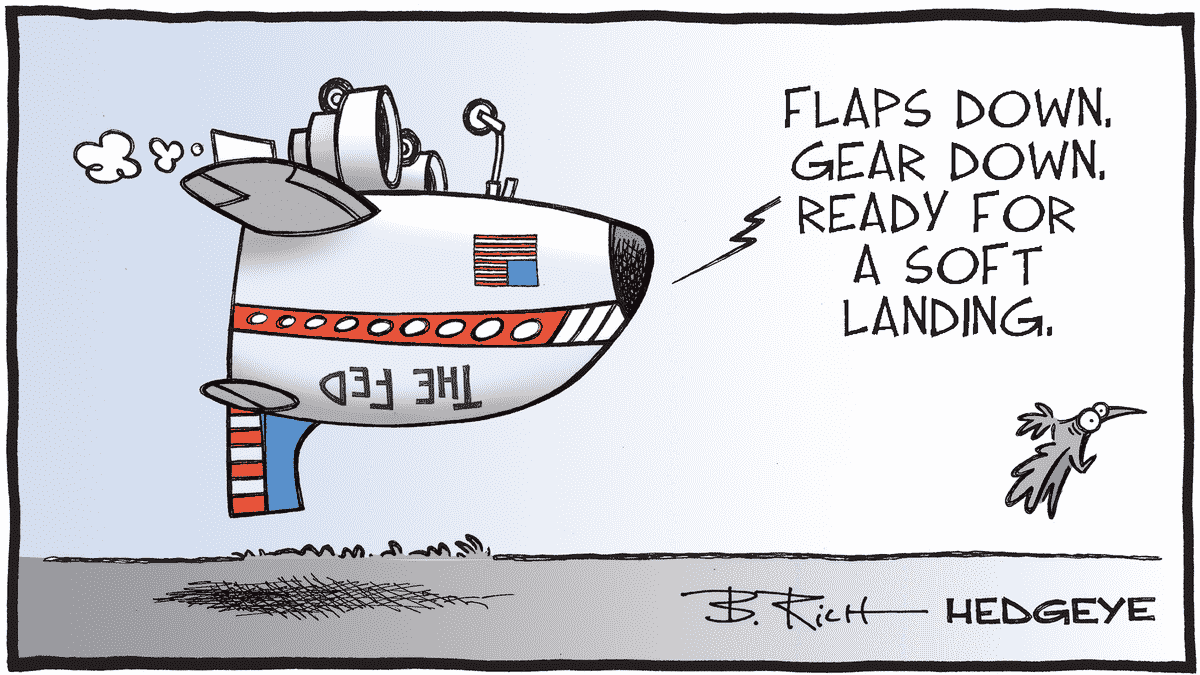

Staying the Course: Financial markets are now predict a soft landing for the economy.

At the start of the year most market commentators seemed convinced that the economy was heading for a hard landing and by the end of the year interest rates would need to come down to get us out of a recession. The obvious trade was to get out of equities and load up into bonds as they would be beneficiaries of higher income and falling rates. But equities have continued to climb while yields keep edging upwards and now market commentators agree that we are in for a soft landing. It’s why as an investor the best trade is to ignore media predictions and stay the course with the portfolio that has been created for you by your advisor.

The Downsizing Dilemma

In retirement, the decision to downsize homes can become important because the implications are significant for your lifestyle and finances. Downsizing involves selling your current, often larger, home and purchasing a smaller, more manageable one. We know this can be a difficult and complex decision, so we have pointed out some of the pros and cons to get you started.

Term Deposits or Bonds - Which is best for your portfolio?

With term deposit rates up around 4.5% or higher, it’s reasonable that investors may question the role of a bond fund in their portfolio. Given that bond funds had their worst return on record in 2022, and term deposits are effectively a risk free investment paying a guaranteed return, why wouldn’t investors use term deposits as the defensive allocation in their portfolio? Term deposits offer short term peace of mind - but a global bond fund gives superior long term returns, better liquidity, greater diversification benefits and are a much better defence against a volatile equity market.